Crypto Portfolio Risk Dashboard

TL;DR

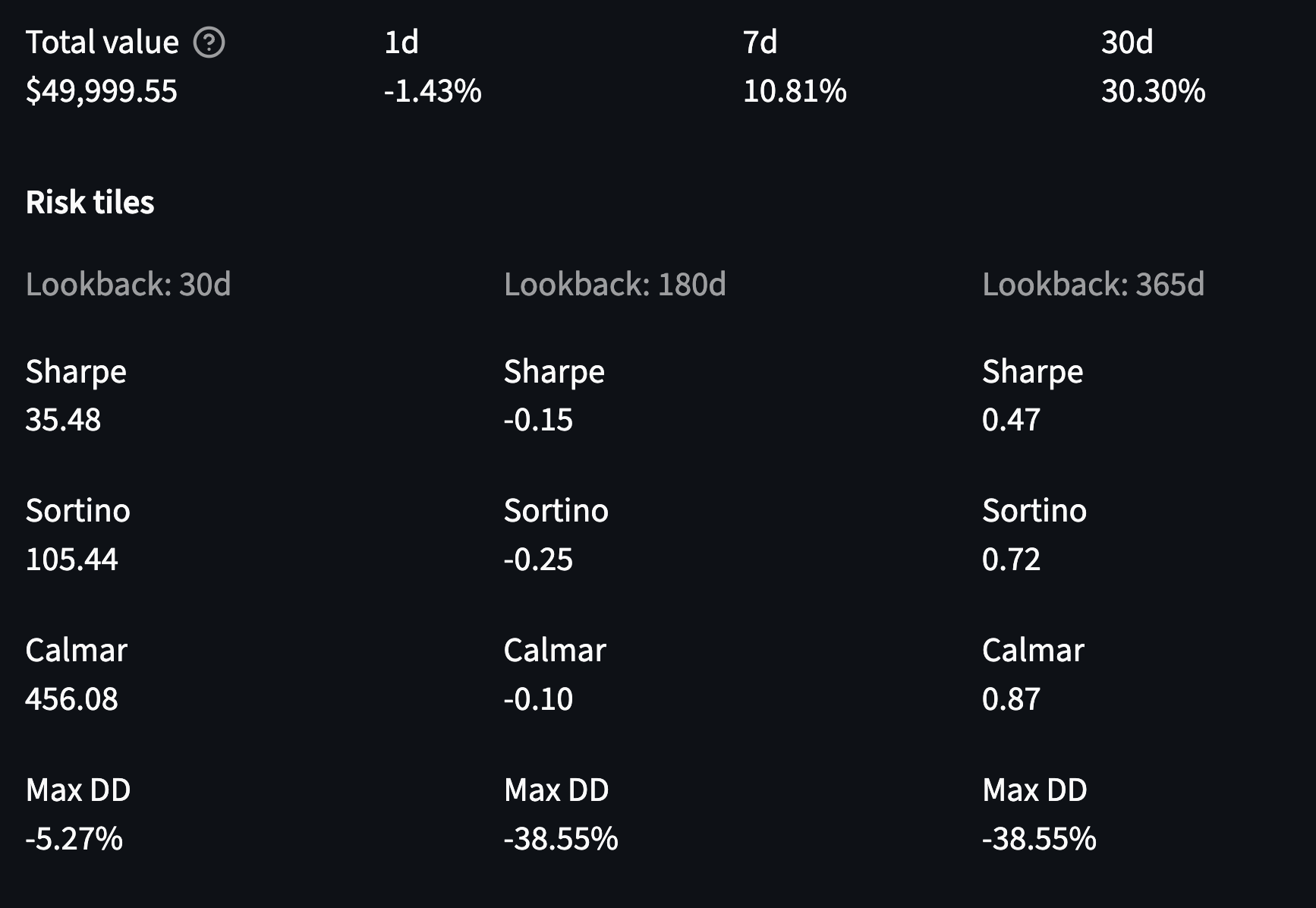

I built a full-stack dashboard that calculates time‑weighted and money‑weighted returns, institutional risk ratios (Sharpe, Sortino, Calmar), max drawdowns, rolling volatility, and multi‑method Value‑at‑Risk (VaR) & Expected Shortfall (ES) for a live crypto portfolio.

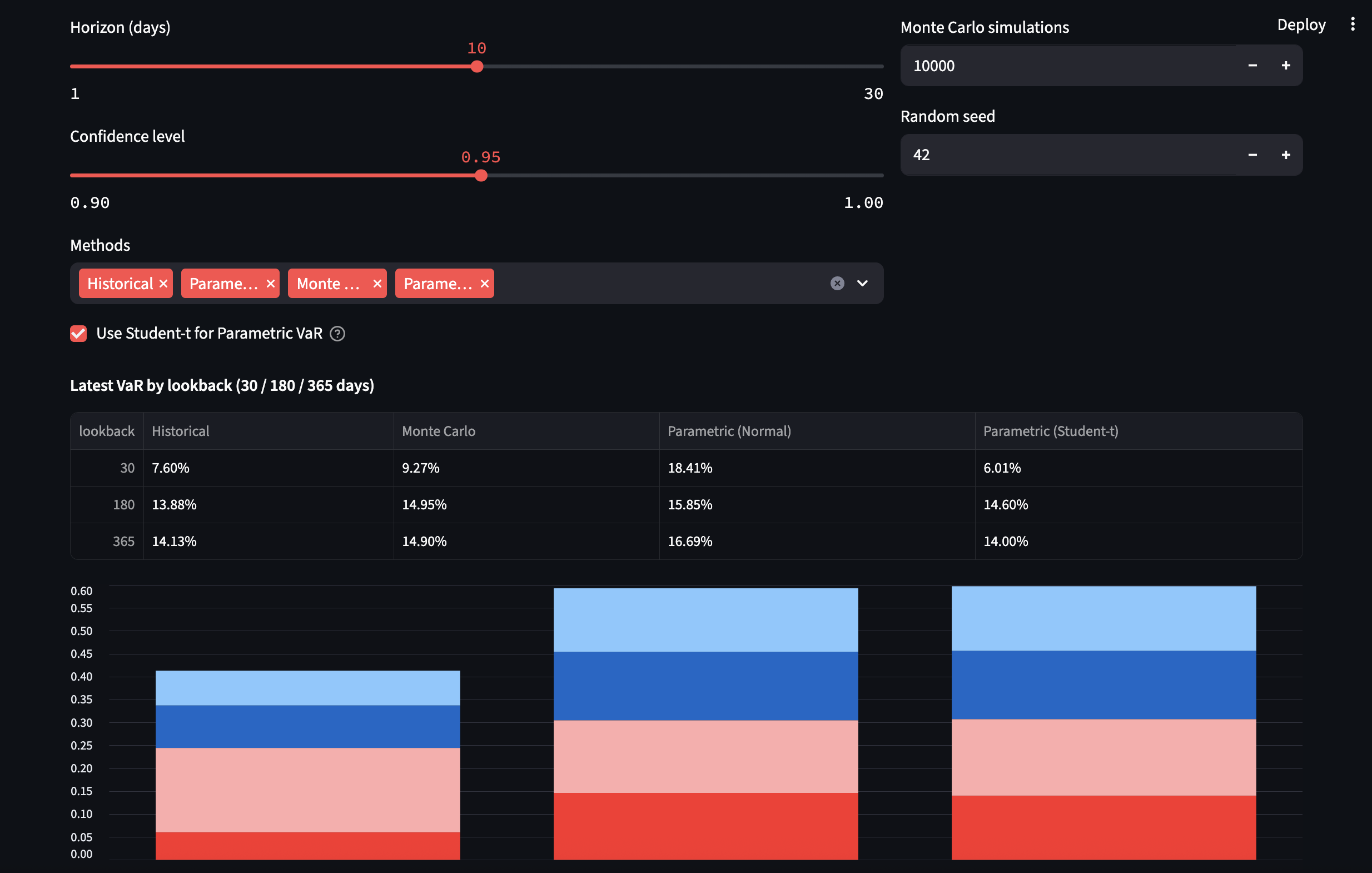

It supports historical, parametric (Normal & Student‑t), and Monte Carlo VaR with configurable horizons and confidence levels, plus forward risk cones and VaR backtesting.

The codebase is production‑minded: typed Python, unit tests, FastAPI endpoints, caching, containerization, and a modular architecture designed to extend to stress tests, regimes, and attribution.

What it does today

Portfolio & Performance

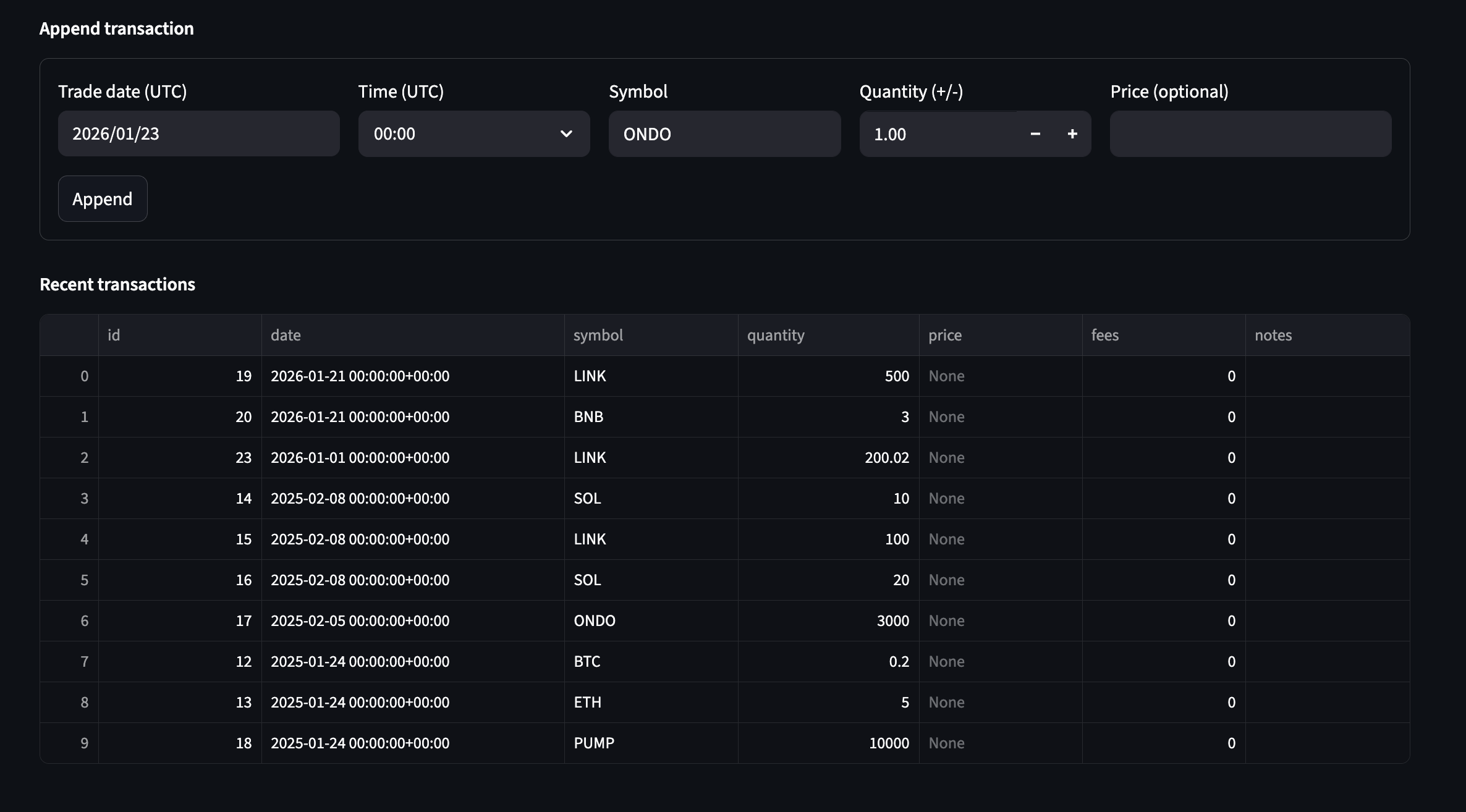

Add/remove assets; compute holdings → weights → daily portfolio returns.

Summary tiles for 1D / 7D / 1M performance.

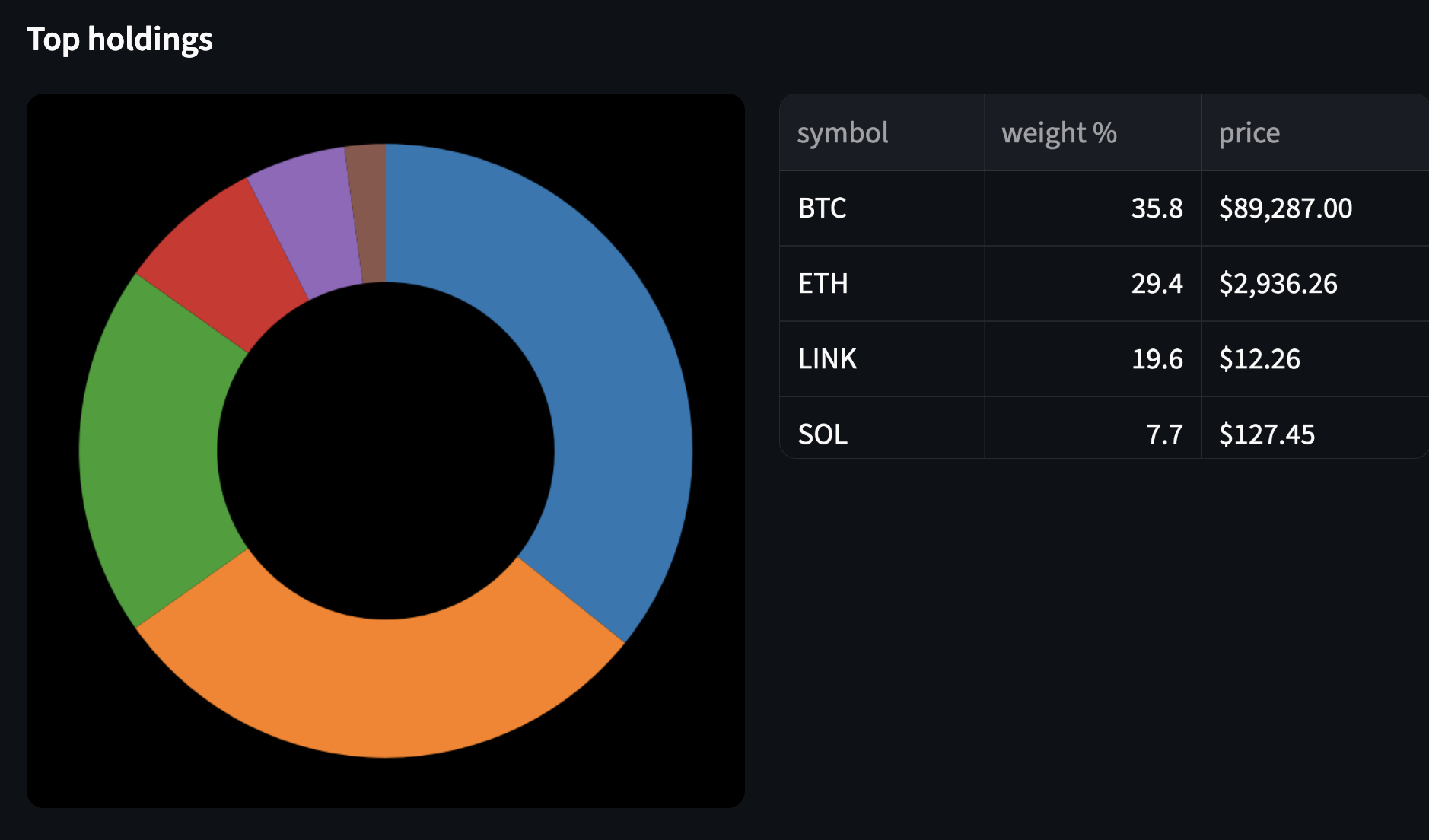

Top holdings with portfolio weight, current price, and trade history.

Risk & Ratios

Sharpe, Sortino, Calmar, and max drawdown over 1M / 6M / 1Y windows.

Rolling volatility and drawdown series to visualize risk through time.

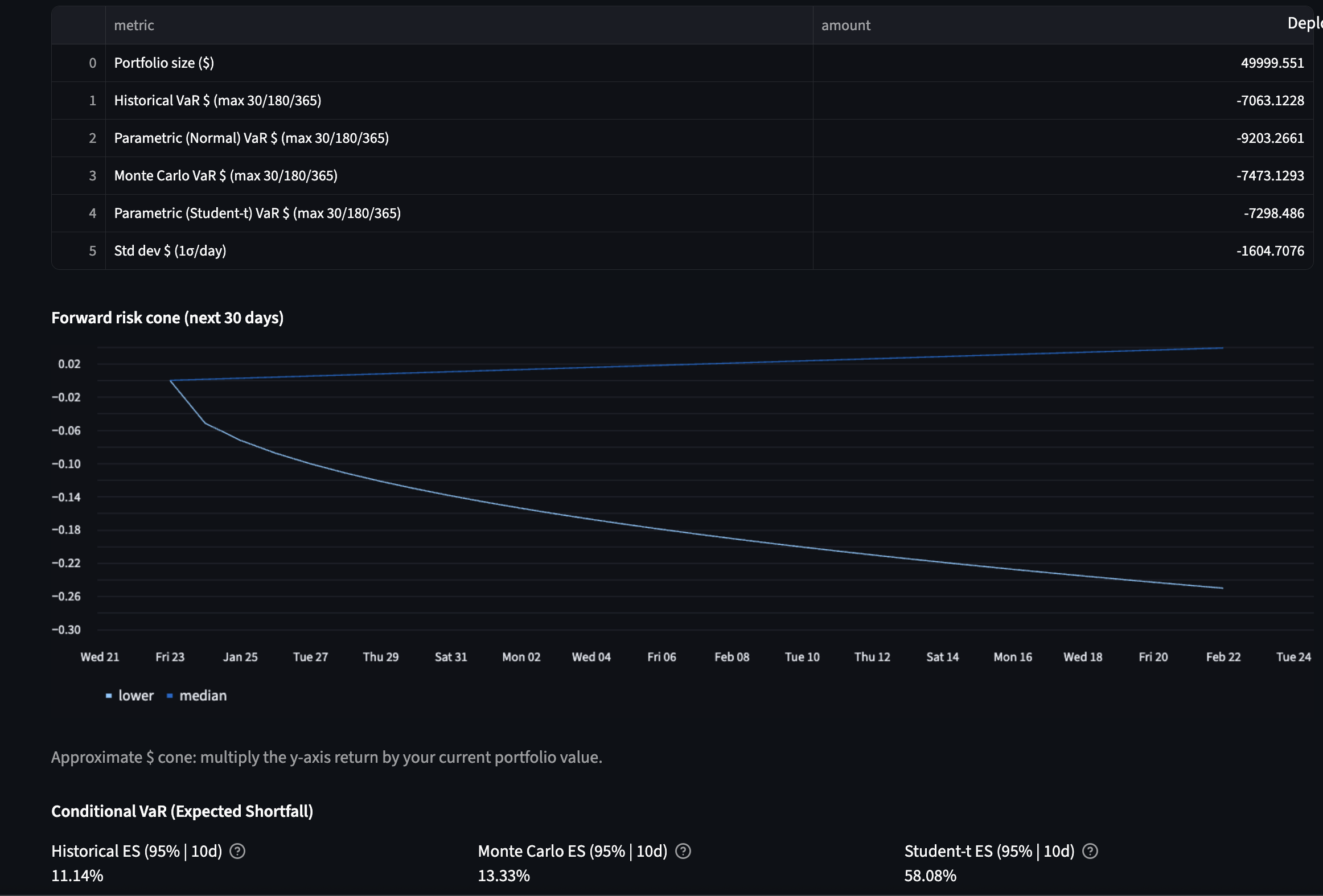

VaR & Tail‑Risk

Historical VaR, Parametric VaR (Normal & Student‑t to capture leptokurtosis), and Monte Carlo VaR.

Adjustable horizon (1 / 10 / 30 days) and confidence (0.90–0.99).

Controls for MC simulation count and random seed for reproducibility.

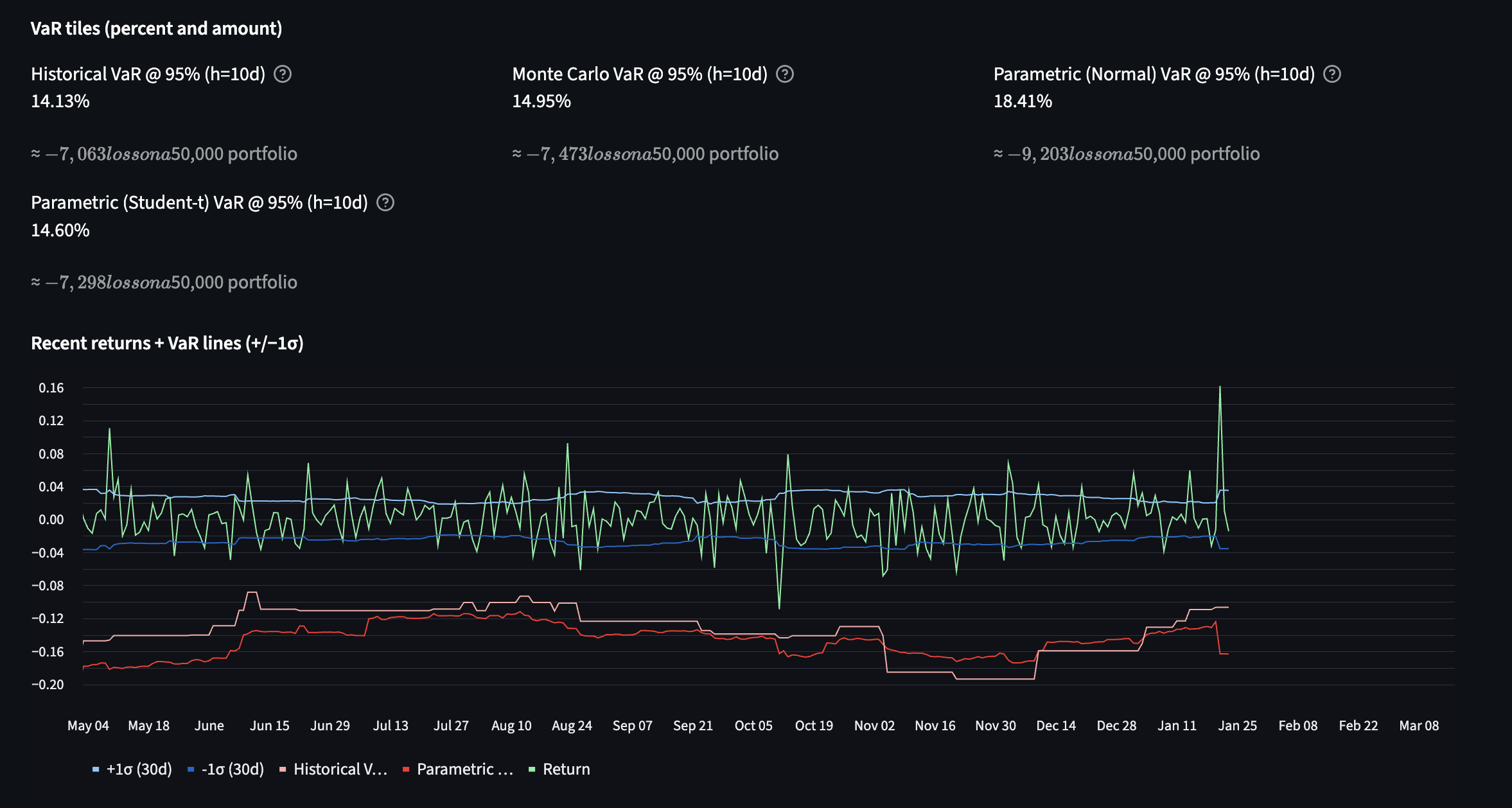

Daily return line with rolling 30‑day σ, and overlaid historical & parametric VaR bands to visualize tail risk.

Forward 30‑day risk cone, Expected Shortfall (CVaR), and monetary loss ranges by horizon/confidence.

UX

Clear bar/line charts, horizon toggles, and risk tiles for quick scannability.

Roadmap (next jobs)

Portfolio analytics

Portfolio variance/volatility; correlation & covariance matrix with shrinkage (e.g., Ledoit–Wolf).

Beta/exposures vs BTC and macro factors; sensitivity to single‑asset shocks.

Benchmarking (BTC, ETH, custom basket) with excess returns and Information Ratio.

Risk & attribution

VaR decomposition (Euler) to see each asset’s contribution to portfolio VaR/ES.

Backtesting of VaR exceptions (e.g., Kupiec/Christoffersen tests) with exception logs.

Stress & regimes

Historical replays (e.g., major sell‑offs, liquidity shocks) and hypothetical shocks.

Regime tagging (volatility states) with summary stats by regime.

Practicalities

Fees/slippage assumptions; transaction‑cost‑aware returns.

Data validation (staleness/NaN guards), monitoring, and alerts.

CSV/PNG export, dark mode, and layout polish.

Options & hedging (stretch)

What‑if put hedges and delta‑hedged overlays; P&L impact by strike/tenor.

Why I built it

Most portfolio trackers show balances and P&L. Few measure risk the way professionals do. I wanted:

A clean layout with asset distribution, weights, and position details.

Proper performance: TWR vs MWR, benchmarkable across horizons.

Risk ratios: Sharpe, Sortino, Calmar, rolling vol, and max drawdown.

Tail‑risk analytics: VaR, ES, forward risk cones, and heavy‑tail models (Student‑t).

Relationships between assets: correlations now, factor/regime analysis next.

This project is my answer: a personal tool with institutional features.

Architecture

A modular repo designed for extension and testing:

repo/

config/ # settings.yaml – data paths, horizons, RF source

data/ # parquet/duckdb (gitignored)

src/

io/ # loaders, calendars

portfolio/ # positions, valuation, returns (TWR/MWR)

risk/ # drawdown, ratios, covariance, var, stress

analytics/ # correlations & rolling stats

factors/ # risk-free & optional macro factors (SPX, DXY, etc.)

utils/ # time, cache, typing, logging

api/ # FastAPI endpoints + pydantic schemas

dashboards/

web/ # React front-end (or)

python/ # Dash/Plotly or Streamlit

tests/ # pytest with fixed seeds

docker/ # containerization (API + dashboard)

Engineering practices

Typed Python with docstrings; pytest unit tests and fixed seeds.

FastAPI + Pydantic for validation; clean schemas at the API boundary.

Caching and parquet/duckdb storage for fast recompute.

Docker for reproducible runs; CI‑friendly layout for future GitHub Actions.

Tech stack

Python (NumPy, pandas), FastAPI, Pydantic, PyMC/NumPy RNG for MC, Plotly/React or Dash/Streamlit for the UI, DuckDB/Parquet for storage, Docker for packaging, pytest for tests.

Work with me

I enjoy turning messy market data into clear, testable risk and performance tools. If you run digital‑asset risk or portfolio analytics and want a pragmatic builder who ships, let’s talk.

If you wish to have access to the GitHub repo to have a look please don’t hesistate to contact me.

This project is for research/education and not investment advice.