Bitcoin Statistical Event Study

TL;DR

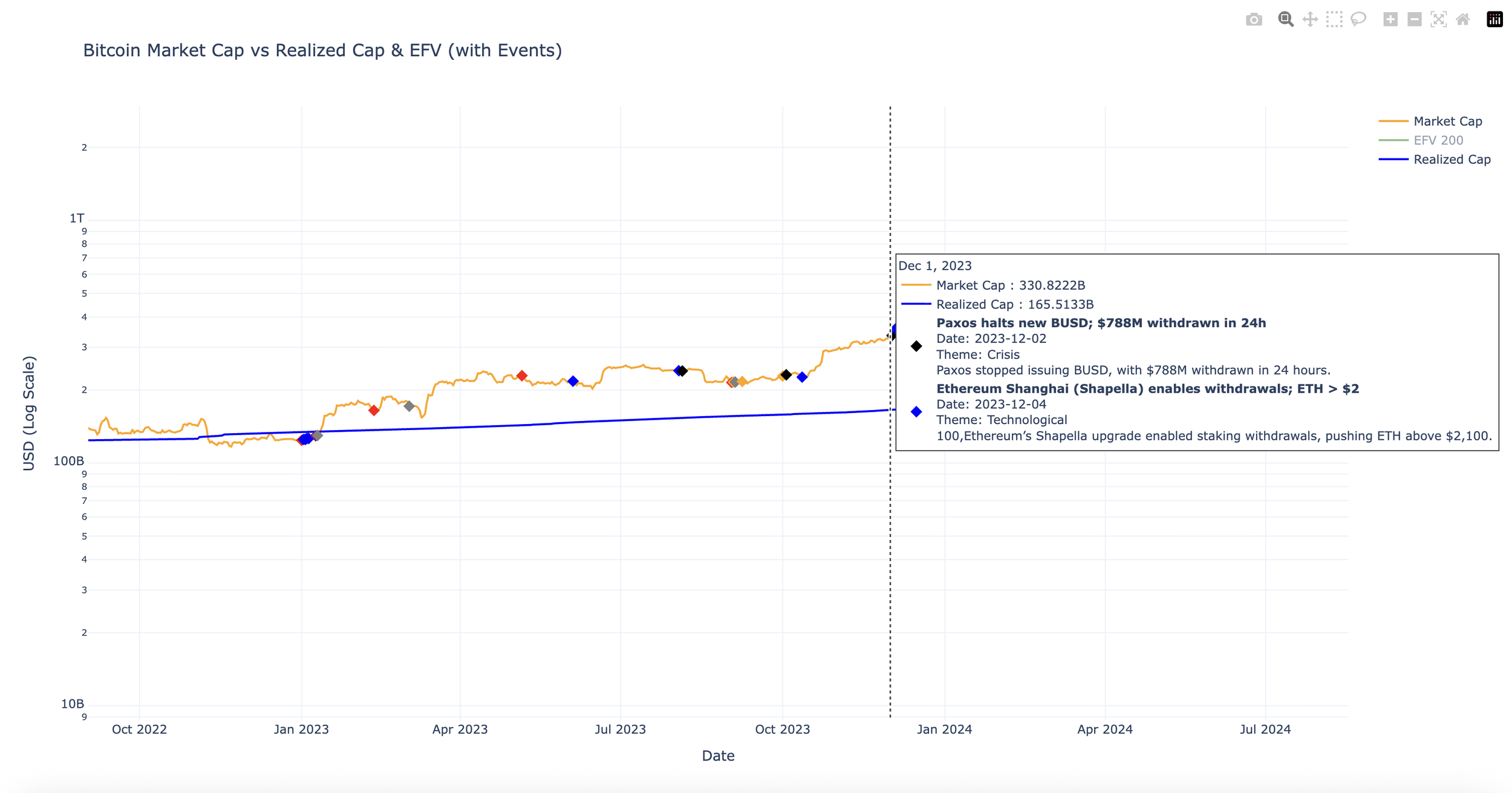

I built a Python event‑study engine and a primary/secondary demand valuation model for Bitcoin. It measures the impact of catalysts (institutional adoption, regulation, tech upgrades, crises, etc.) on returns across ±1/3/5/10/15/30‑day windows, then regresses the secondary premium (price – fair value) on liquidity and macro factors.

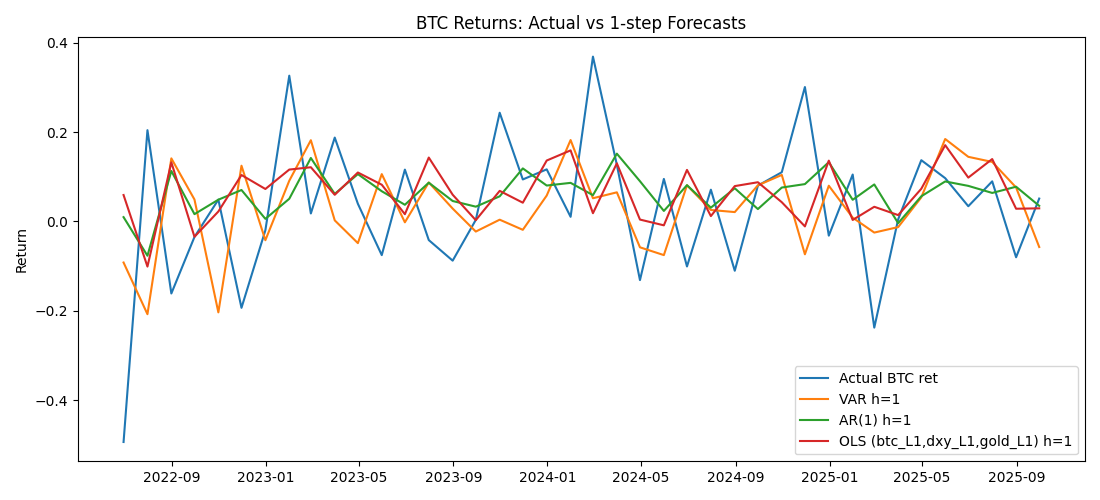

Findings: Institutional/adoption and protocol/tech upgrades drive the most persistent positive drift (weeks). Negative regulatory shocks hit on day‑1 but mean‑revert over longer windows. Dollar strength (DXY) is inversely related to next‑month BTC returns; BTC shows short‑term momentum.

Output is presented as valuation bands (bear/base/bull) for 2025 rather than a single point target, with clear attribution between structural (primary) and cyclical (secondary) components.

Why I built it

Most crypto “valuation” is narrative. I wanted a framework that:

Separates signal from noise by isolating structural adoption from cyclical enthusiasm/fear.

Quantifies event impact using standard CAR/AR windows and rigorous significance tests.

Produces an explainable fair value and a measurable premium/discount relative to that fair value.

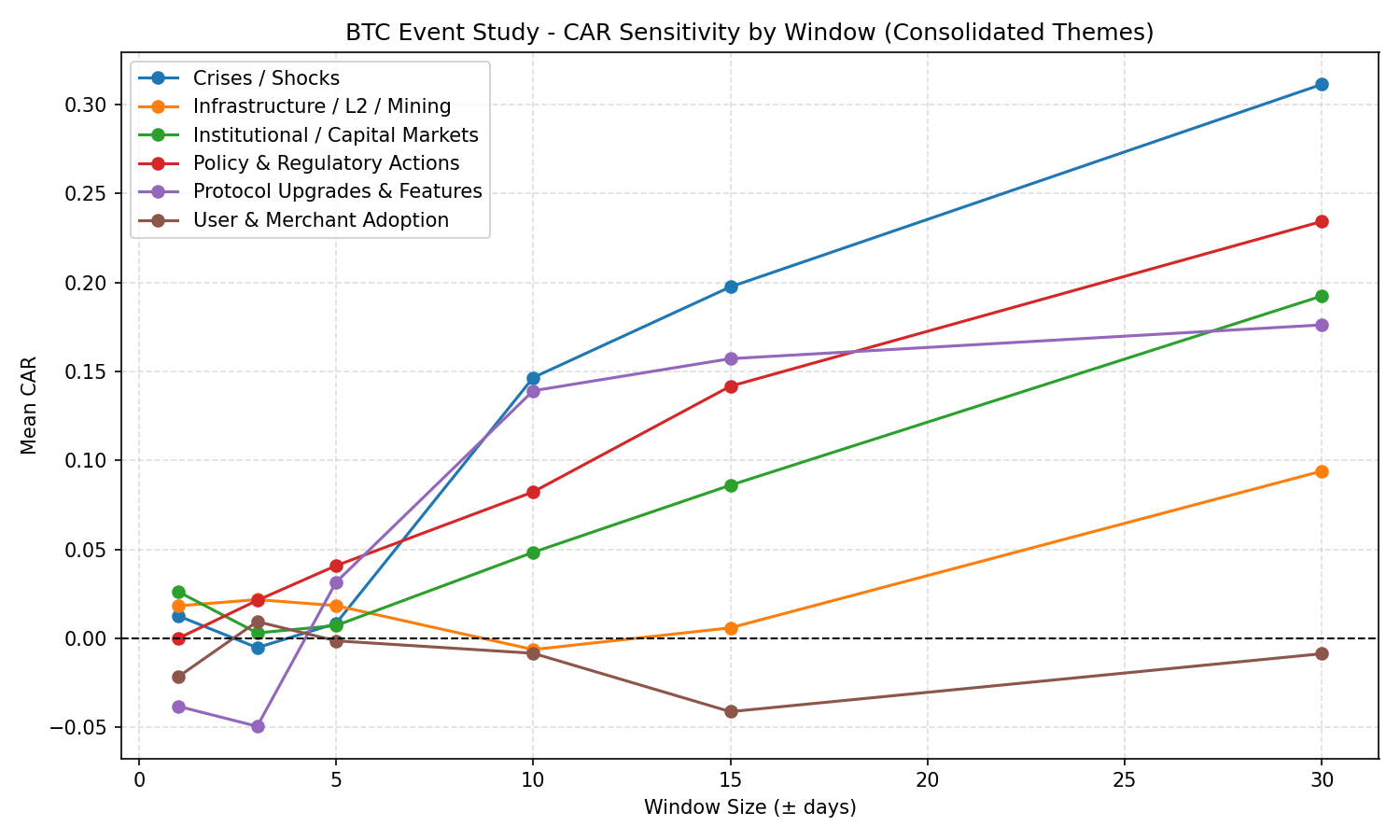

Results – Event Study (selected highlights)

By Theme (mean CAR; significance refers to t‑tests in sample)

Institutional Adoption: positive and persistent; significance emerges by ±3–5d and strengthens through ±15–30d.

Protocol/Technological Upgrades: effects build with horizon; insignificant near ±1d, significant by ±15–30d.

Policy/Regulation (mixed): small in short windows; positive drift at longer windows; polarity matters.

Crises & Stress: muted on impact; no consistent sustained drawdown on average.

Market Infrastructure/Liquidity: positive but not significant; likely gradual/anticipated.

Adoption/Usage: small sample; directionally positive at longer windows, not conclusive.

Regulatory Polarity

Negative regulatory events: day‑1 selloff (significant), but mean‑reversion by ±15–30d.

Positive regulatory events: immediate upside; persistence varies with context; sample size smaller.

Roadmap (next)

Data & Taxonomy

Expand labeled events; add polarity, magnitude, and surprise scores.

Attach on‑chain features (LTH %, realized cap, fee pressure) at event timestamps.

Modeling

VaR‑style exception tests for event‑driven drawdowns.

Attribution: Euler contributions of factors to secondary premium variance.

State space/Markov regimes for premium dynamics (calm/elevated/panic).

Out‑of‑sample validation and rolling re‑fit.

Productization

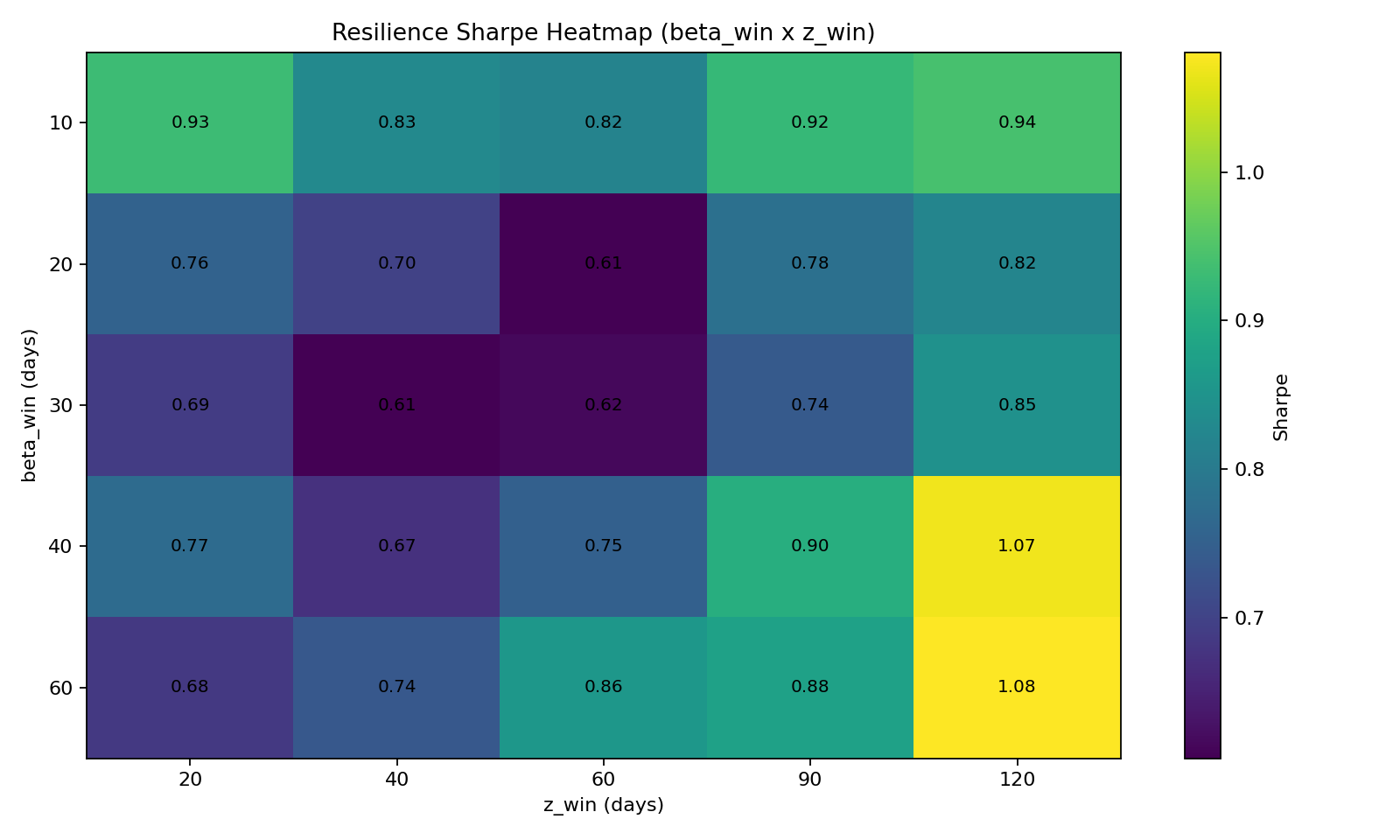

Bundle as a FastAPI microservice; add dashboard tiles (heatmap, premium band).

Standardize / rescale inputs (z-scores) to reduce condition-number issues and improve numerical stability.

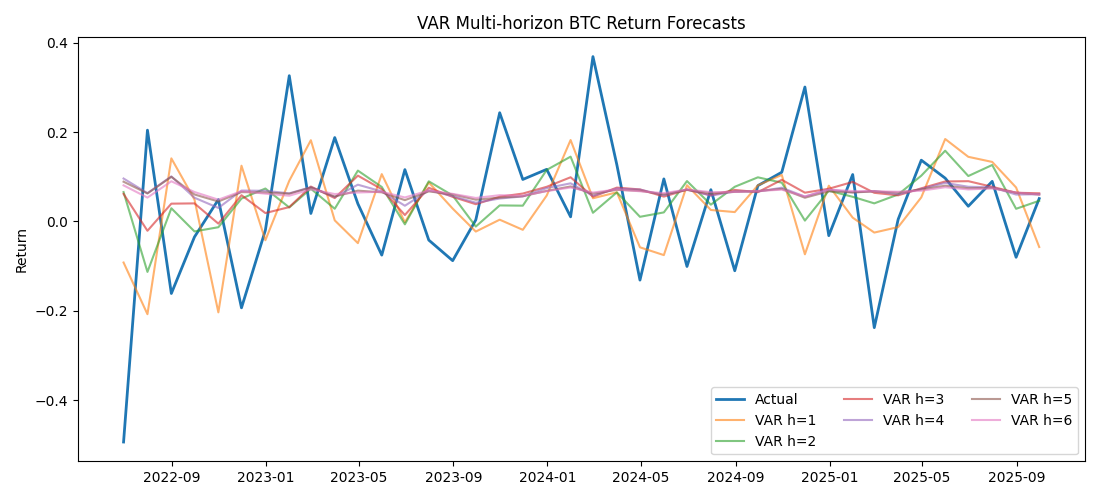

Try lag=1 VAR (BIC/HQIC choice) and compare true OOS performance (rolling/expanding window).

Make sure everything is stationary (ADF tests). If ISM is a level, it may be problematic; consider changes or surprises (diff from expectations).

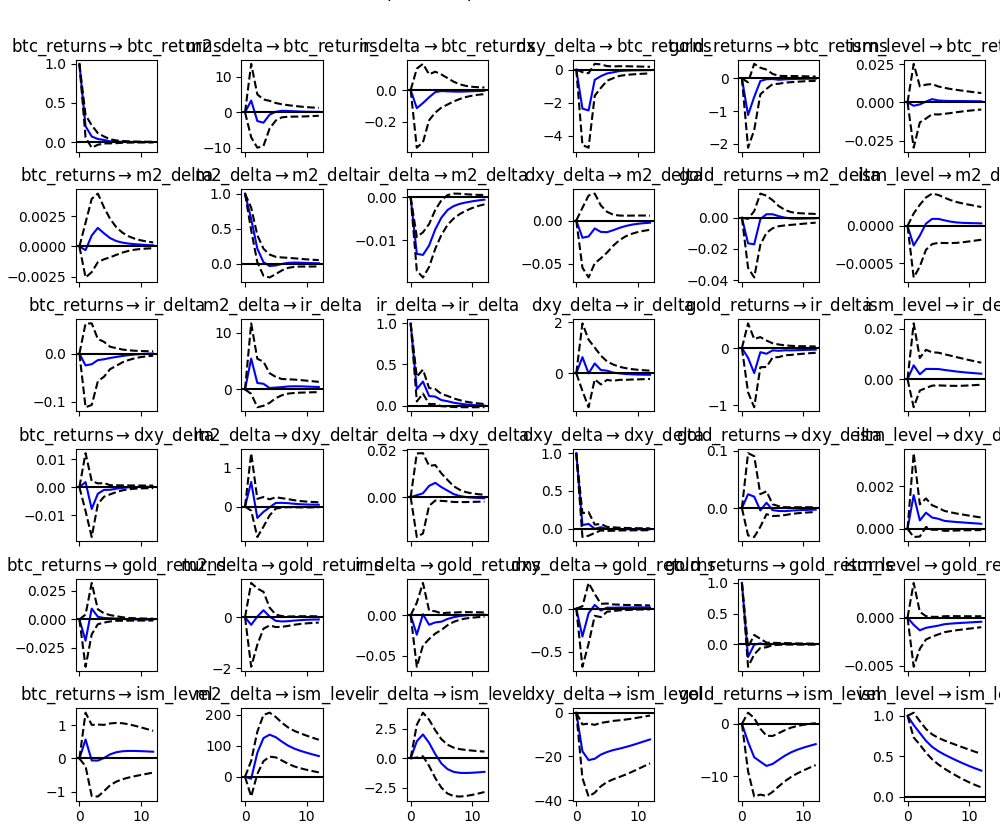

Use robust inference (HAC / Newey-West for OLS; robust covariance options for VAR where possible).

Add variables that actually move crypto at short horizons: SPX/Nasdaq returns, VIX, credit spreads, liquidity proxies, BTC realized vol, funding rates, etc.

Consider nonlinear / regime approaches (Markov switching, tree-based models, quantile regression) because linear-Gaussian VARs struggle with fat tails and regime shifts.

What it does today

Event Study Engine

Curated event taxonomy (Institutional/Adoption, Protocol/Tech, Policy/Regulatory ± polarity, Market Infrastructure/Liquidity, Crises & Stress, Usage/Commerce).

Computes abnormal returns (AR) and cumulative abnormal returns (CAR) over ±1/±3/±5/±10/±15/±30 windows.

Summarizes mean CAR, t‑stats, p‑values, and inference by category/window.

Multi‑Factor Valuation

Primary (Structural) Demand

TAM: share of global wealth/M2 addressable by BTC.

Stock‑to‑Flow: scarcity proxy.

DCF‑style annuity: CAGR‑based cash‑like store‑of‑value utility.

Metcalfe’s Law: network effect (value ∝ users² / cost proxy).

Secondary (Cyclical) Premium:

Residual Market Price – Primary Fair Value.

Regress on liquidity (M2, balance sheet), real yields, futures funding/open interest, stablecoin supply growth.

Macro Links (Monthly VAR/OLS)

Short‑term momentum in BTC; inverse DXY and inverse gold relationships at 1–2‑month horizons.

Limited evidence that M2/ISM/rates predict monthly BTC returns in this sample.

Outputs & UX

Valuation bands for 2025 (bear/base/bull) from the primary model + secondary premium overlay.

Heatmap: event type × window with significance stars.

Time‑series panel: price, primary fair value, and secondary premium.

Practical Data Sources

On‑chain: Glassnode, Nansen, IntoTheBlock.

News & regulatory: Factiva/LexisNexis, CoinDesk archives, official gov/regulator sites.

Market & liquidity: futures OI/funding, stablecoin supply, CB balance sheets, real yields.

Tech Stack

Python (NumPy, pandas, statsmodels), matplotlib/Plotly for figures.

Jupyter for exploration; export to CSV/PNG for reproducibility.

Work with me

If you run digital‑asset research or risk and want a pragmatic builder who can measure catalysts, explain premiums, and ship tools, let’s talk.

Research/education only; not investment advice.