Algorithmic Trading Strategy

TL;DR

I’m building a production-minded trading system that detects Bull/Bear regimes, confirms them with forward-looking rules, and selects directional strategies accordingly.

The system emphasizes robustness: Monte Carlo, walk-forward, cluster analysis, overfit checks, and risk management (position sizing, leverage caps, drawdown brakes, and kill switches).

Current focus is BTC; the framework generalizes to alt assets with re-tested parameters.

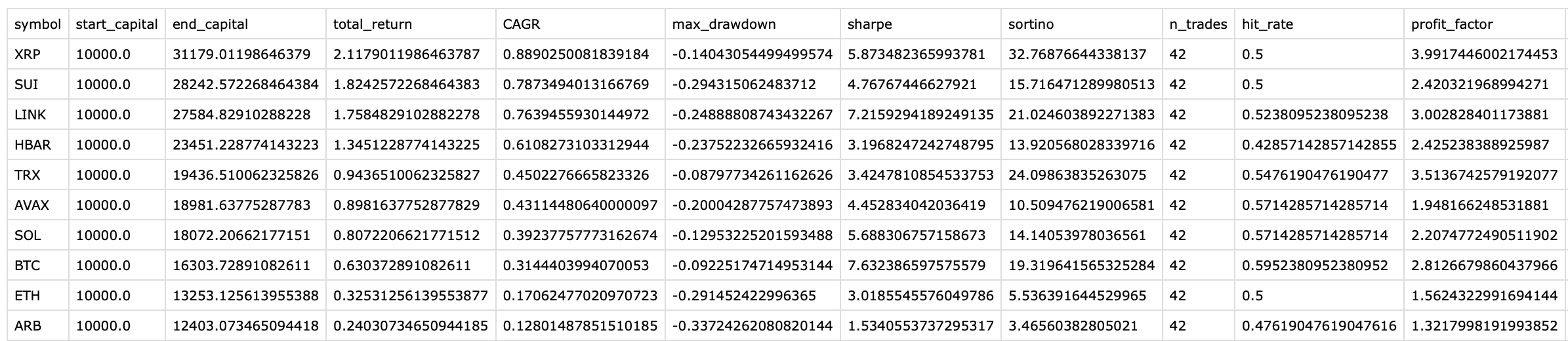

Output: reproducible tests, clean performance & risk reporting (CAGR, MAR, Sharpe/Sortino, hit rate, expectancy, turnover, capacity), and post‑risk‑integration re-validation.

Why I built it

Most “crypto algos” optimize for a backtest screenshot. I want a system that adapts to market regimes, ships with guardrails, and survives contact with the real market—fees, funding, slippage, and path dependence.

Tech Stack

Python (NumPy, pandas), CLI experiments, planned pytest suite, reproducible configs.

Future: integrate with the risk dashboard for unified analytics.

What it does today

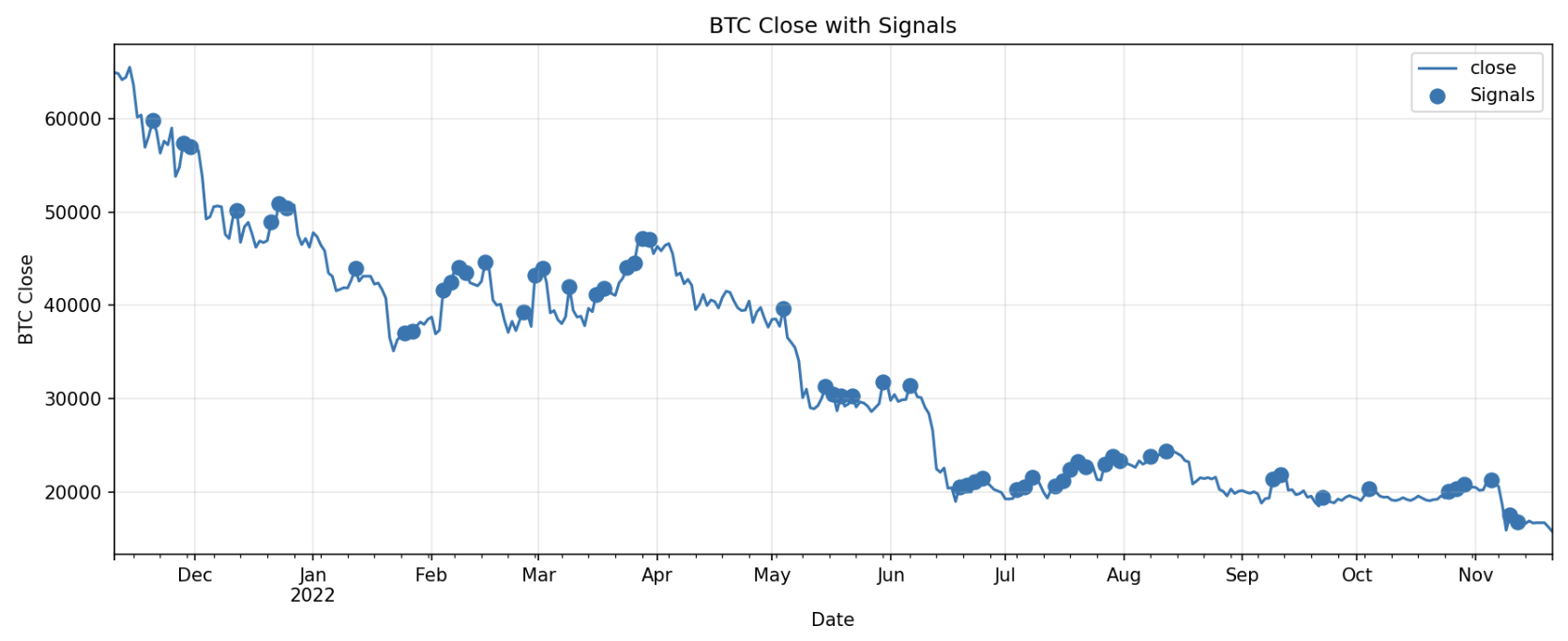

Regime segmentation (BTC)

Roughly segment historical Bull & Bear markets to map which strategies belong in which conditions.

Early CLI experiments to validate rise/fall signal behavior and minimum move thresholds (e.g., --signal_kind rise --min_move 0.05 --win_min 1).

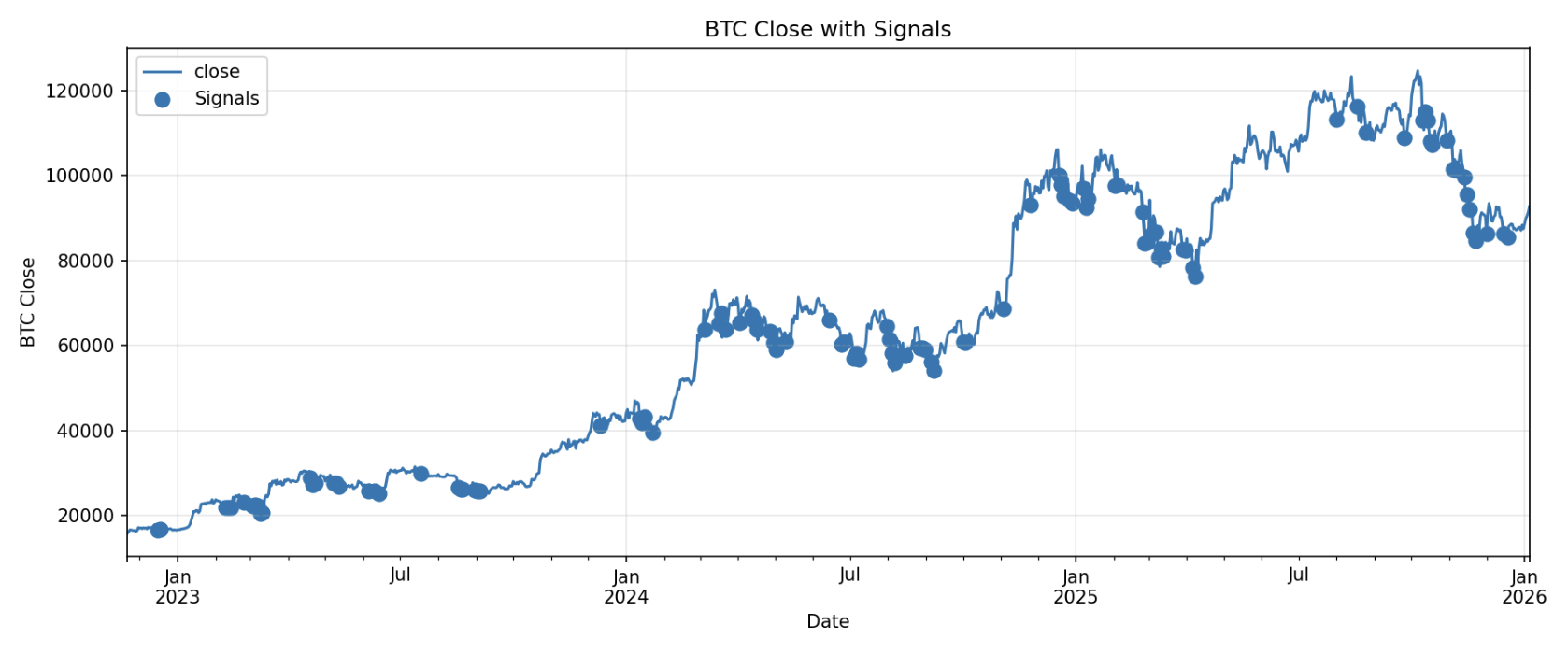

Regime confirmation simulations (BTC)

Simulate forward‑looking confirmation rules (no hindsight) to switch Bull‑oriented vs Bear‑oriented strategy templates.

Screen and keep parameter sets that are consistently adequate; dropped the rest.

Parameter curation

Carried forward a shortlist of inputs for advanced testing: minimum drop, entry delay, cooldown, leverage, etc.

Maintained control variants to test hypotheses and avoid researcher degrees of freedom.

Advanced testing (design)

Monte Carlo resampling, walk‑forward splits, cluster/bootstrapped regimes, in‑sample excellence vs OOS realism, overfit checks (e.g., PBO).

Plan to marry quant results with qualitative market context.

Risk management (design)

Tiered position sizing, hard leverage caps, vol‑scaled exposure, drawdown brakes, time‑outs, daily loss limits, and circuit breakers.

Post‑integration test to confirm the risk layer achieves its purpose without killing edge.

External macro affectors (design)

Identify and tag DXY, real yields, funding, stablecoin flows, liquidity regimes as potential context features for filters or position scaling.

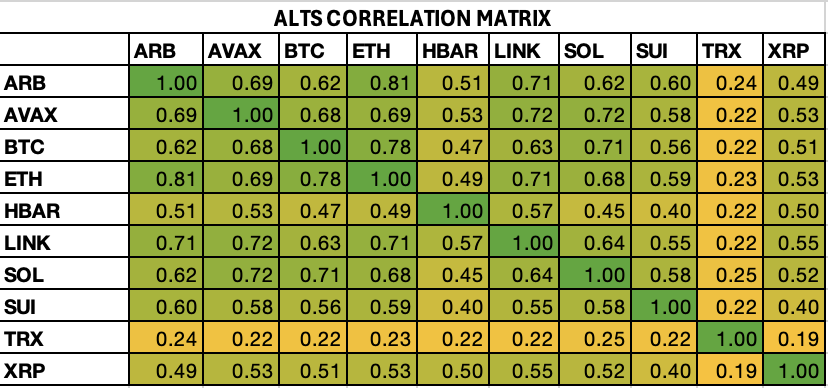

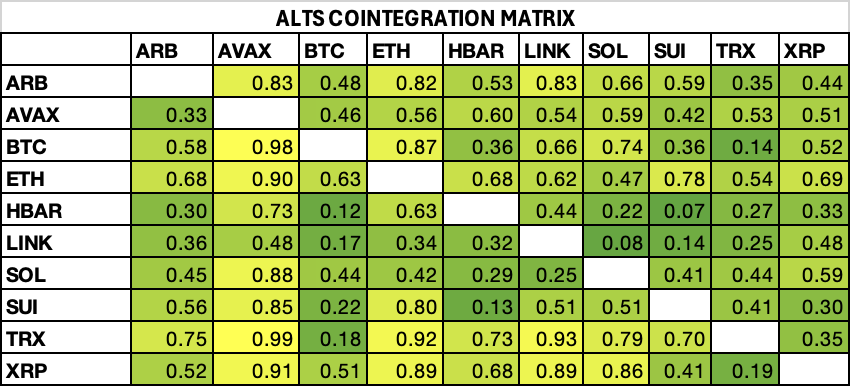

Alternative assets (design and testing)

Extend pipeline to selected alts, re‑test parameters and risk.

BTC signal entries in alts to increase strategy convexity

Work with me

If you care about regime‑aware, risk‑first trading that survives real costs and volatility, I’d love to collaborate.